I just visited Dubai and made some observations about its property market. There is a bubble being inflated right now and it can probably get bigger before it pops. Why?

Let's begin with how all bubbles begin. There need to be a trigger otherwise higher property prices will moderate demand and there is no financial bubble.

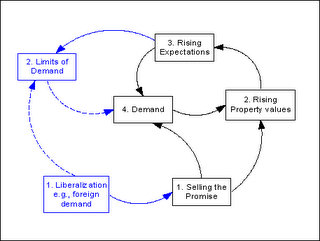

Financial bubbles always come about because buyers believe that prices will go up. The Dubai government has been very successful at selling their city as the key business and life-style location of the Middle East, fashioning it as the Singapore or their region See Box 1 (black box). This led to rising property values as buyers rushed in to bet on the promise and success (box 2). The first wave of buyers provided the indispensable vote of confidence. This creates subsequent waves of higher expectations of property price (box 3), feeding towards even more demand for Dubai properties (box 4).

Eventually prices become so high that demand begins to wane (blue box 2). If this happen, the property bubble is ready to pop. Nobody can anticipate how and when this stage is reached and therefore to prevent a crash the Dubai government has to prepare and always be ready with a set of liberalization initiatives to support greater demand and higher prices (blue box 1). As long as Dubai is willing to keep making foreign ownership more attractive, this bubble can inflate quite a bit more. Of course, as the bubble gets bigger the risk of a crash also become more significant. The wish of any government is to engineer a soft landing but this is not easy to achieve. As of now, this property bubble has more life left in it. So I wouldn't bet for a crash yet, but stay vigilant and use this NaviMap to help you organize your data and understand what is happening in this market.